How do I apply our sales tax (VAT) rate?

LoveAdmin sets the standard VAT rate based on the country your organisation is based in. If you pay a different tax rate, or none at all, it is important you update this in your settings to ensure your financial reporting is correct

How tax (VAT) is reported in LoveAdmin

Tax is always included in the price of your products; adjusting your tax rate will not change the cost of any products but will help you report on the tax you need to pay as part of the sale.

How to set your tax rate

- Navigate to Settings > Organisation > Accounting / billing

- Enter your primary tax rate into the field "Primary Sales Tax Rate"

- Click "Save" at the bottom of the page.

If the "Primary Sales Tax Rate" box is empty, it means the tax rate is set to the default value for the country your organisation is based in.

If your club claims tax back, leave the tax rate as it is and use the figures in your reports to claim the money back.

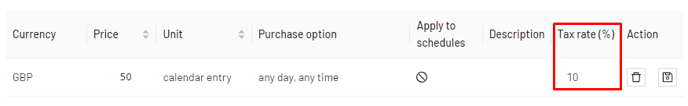

Tax rates for individual products

It's also possible to set a unique tax rate for an individual product:

In Settings > Products > Pricing, you can select the specific product or product group and set a tax rate that will override that set in your Organisation settings:

Tax Report

You can find your Tax Report in Home > Reports > Financials > Tax.

This will show you how much tax is due on each transaction and quickly get a month-on-month summary of your tax calculations.

For more information, view the full article here.