How do I resolve failed payments?

This article helps to explain why some payments may fail and how these situations can be resolved

Note: Email notifications can be sent to your administrators, and your customers, if payments fail. For help managing your notifications, read our help article here.

Reasons for payment failures

Payments can fail for various reasons. Common reasons for failed payments include:

- Insufficient funds in the customer’s account

- Bank account is closed or invalid

- Direct Debit cancelled by the customer

- Banking errors or delays

A list of common failure errors can be found further down this page (Click here to scroll).

Important: When customers make payments through Direct Debit, they may sometimes notice that funds have been deducted from their bank account, even though the payment was reported as unsuccessful.

This can happen when a payment is in the process of being collected. During this time, the bank temporarily withdraws the amount from the customer's account. If the payment ultimately fails, the bank will reverse the transaction and refund the amount to the customer's account.

You can access our troubleshooting guide in the help section here.

Where to find failed payments

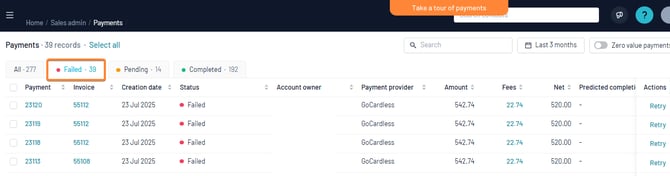

You will find all payments that have been initiated, and their respective statuses, under Sales Admin > Payments.

To filter to your failed payments, click the 'Failed' tab along the top of the payment table:

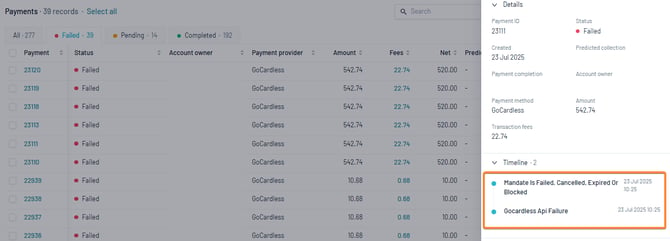

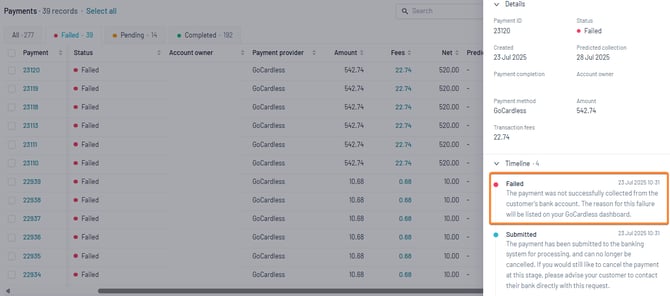

Click on the payment number to view more details about the payment failure. In some cases, you may be directed to your payment provider portal for more information on the failure:

In other cases, the reason for the failure will be listed:

Retrying failed payments

In many cases, LoveAdmin will retry failed payments automatically after 24 hours. If the first payment submission fails, this will be followed by three further retries.

Automatic retries however will not occur in circumstances when a payment has manually been cancelled, for example a customer has cancelled their direct debit instruction. In these situations, a customer must attempt to make the payment again, with new payment details.

To manually retry a failed payment once all automatic attempts have stopped, you can click on the 'Retry' action in the Actions column under Home > Sales admin > Payments.

Important: If you are a GoCardless customer then GoCardless will apply a surcharge for each failed payment that they re-attempt—this is only for their fees. LoveAdmin's fee will be applied only when the payment is successful.

Failure messages

REFER_TO_PAYER

This failure message is returned for several reasons. One is that there was a connection error between banking systems, another is that the payment has been blocked by the bank or that there were insufficient funds in the account to make the payment. It is not possible to know exactly which reason was behind this error message.

- How to resolve

The system will automatically retry the payment the following day, after the payment failure is recognised.

THE CUSTOMER ACCOUNT IS SUSPENDED; The customer account is suspended. No actions regarding payments will take place when the customer is suspended (also known as end dated).

The bank account itself either doesn’t exist or is unable to process direct debits for *some* reason. Possible reasons and recommended actions are:

- Account Number is not recognised at the paying bank

- Direct Debit information is incorrect. If appropriate, the contact should set the direct debit up again from the Payment section of their LoveAdmin account.

- In some cases, there may also be an issue at the bank and the contact should contact their bank for further advice

- How to resolve

Your customer will be required to make the payment again. They can find their outstanding invoice in their JoinIn account:

- Log in to https://app.joinin.online.

- Outstanding invoices will be displayed on their JoinIn homepage, or under the Payments menu

INSTRUCTION CANCELLED / NO INSTRUCTION

The customer's Direct Debit mandate/instruction, has been terminated and no further payments can be authorised. This is most commonly actioned by the bank account owner before a requested payment has been collected.

Your customer will be required to make the payment again. They can find their outstanding invoice in their JoinIn account:

- How to resolve

Your customer will be required to make the payment again. They can find their outstanding invoice in their JoinIn account:

- Log in to https://app.joinin.online.

- Outstanding invoices will be displayed on their JoinIn homepage, or under the Payments menu

PAYMENT_EXCEEDS_LIMIT_OF_PAYMENT_AMOUNT. MAXIMUM VALUE IS...

This error occurs when the payment amount exceeds the maximum limit set by London & Zurich for your merchant account. The maximum limit is determined based on your business risk assessments.

If you encounter this limitation, you can contact the London & Zurich team directly at customer.services@landz.co.uk to discuss your limits and merchant account further.

NO INSTRUCTION

This error will occur if a Direct Debit mandate has expired. This will typically be the case if there have been no collections from the Direct Debit mandate in the last 13 months.

- How to resolve

Customers have the option to setup a new Direct Debit mandate either through their JoinIn account or when they proceed to make their next payment.

INSTRUMENT_DECLINED

Error returned due incorrect card details entered.

- How to resolve

Ask the payer to retry their payment and ensure card details are entered correctly.